ABOUT

Blending business principles with social innovation and thus moving both worlds closer together is what the business of Barbara Kleinjohann is about. It is about making a positive change in the community, both in emerging economies and developed countries, offering advisory services, technical assistance and skills to those who would like to make a change and achieve a positive impact.

Having worked in investment banking as well as in development finance, areas at the opposite end of each spectrum, Barbara believes that both worlds can benefit from each other. In fact they have to become one world, where operating a business profitably and acting in a responsible manner should not be mutually exclusive objectives. Its about striking the right balance when it comes to social, economic and ecological aspects.

With more than 20 years of professional experience, Barbara combines her expertise in banking & finance with development finance, entrepreneurship and social innovation to provide financial advisory & implementation services in emerging and developed economies in the areas of

As financial advisor she works with development finance institutions and commercial banks, donors, NGOs and foundations as well as private equity, corporates, SMEs and social entrepreneurs.

- ✓Financial inclusion & access to finance

- ✓Impact investment & sustainable business models

- ✓Financial advisory for SMEs, corporates and financial institutions

BIO

With two decades of expertise in banking and private equity, Barbara is a seasoned banker. She worked with Deutsche Bank, JP Morgan as well as terra firma in Frankfurt, London & New York.

Her key expertise is in cash flow based lending, assessing business models and strategies, managing due diligence and structuring & underwriting financing transactions, in particular acquisition / LBO finance, investment, project and housing finance in a variety of industries with transaction sizes ranging from €1 mio to more than €1 billion.

In 2007, Barbara set up her own firm to advise private equity investors, banks as well as SMEs / corporates in debt finance, portfolio and risk reviews as well as in due diligence projects.

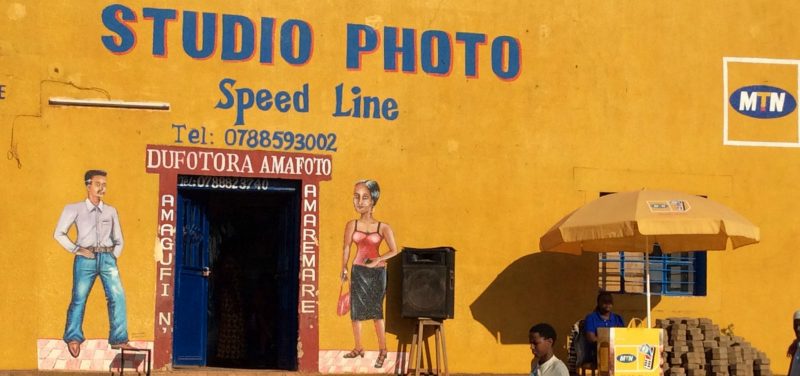

In 2009, she got acquainted with the idea of microfinance and since then dedicates substantial time to advise on and implement projects in terms of access to finance, development finance & sustainable business models, providing training and advisory services to donors, banks, SMEs & corporates in emerging economies such as Rwanda, Ghana, Vietnam, Myanmar, Lao P.D.R, Nepal and China. Barbara also acts as a business coach & sparring partner.

Barbara is an experienced project manager, passionate traveller and photographer. She loves to meet people in other parts of the world and move between the commercial and the developing world allowing her to put things into perspective

SERVICES

FINANCIAL INCLUSION

- ✓Financial sector reviews

- ✓Feasibility studies & risk reviews

- ✓Bank diagnostics

- ✓Financial due diligence

- ✓Debt finance

- ✓Investment projects

- ✓Training needs assessment

- ✓Training & institutional capacity building

IMPACT INVESTING & SUSTAINABLE

BUSINESS MODELS

- ✓Investment processes

- ✓Financial due diligence

- ✓Investment readiness

- ✓Portfolio & risk reviews

- ✓Workshops “Financial skills for non finance executives”

- ✓Coach & sparring partner for i.a. strategy & business development, financing

COMMERCIAL & INVESTMENT BANKING

- ✓Financial due diligence

- ✓Risk & portfolio reviews

- ✓Debt finance

- ✓Credit risk appraisal of banks, corporates, projects, portfolios

References

FINANCIAL INCLUSION & IMPACT INVESTING

Rwanda

SME Financial Sector Technical Assistance

Project sponsored by

China

SME Lending Business Model & Training

Myanmar

Market Review on Banking Competency Requirements

Project sponsored by

MENA

Financial Due Diligence of Banking Institution

for

Vietnam

Feasibility Study & Concept Design for SME Innovation Vouchers

Project sponsored by

Emerging Economies

Financial Due Diligence

Project sponsored by

Sub Saharan Africa

Social Business Fund

Project sponsored by

Ghana

Social Business Model Agricultural Value Chain

LAO P.D.R.

Access to Finance

Project sponsored by

Myanmar

SME Access to Finance

Project sponsored by

Germany

Impact Investments

Business coaching & advisory

![]()

Nepal

Feasibility Study

Rural MSME Value Chain Finance

Project sponsored by

COMMERCIAL AND INVESTMENT BANKING

German Commercial Bank

Financial assessment of Landesbanken & European Commercial Banks

German Financial Institution

Review and assessment of non / sub performing loan exposures in Germany, US and Asia

Private Equity

Due diligence & risk review of a loan portfolio of a German commercial bank for the purposes of acquisition

Private Equity

Recapitalisation / refinancing of portfolio company active in consumer goods

Private Equity

Advisory on due diligence & financing for the purposes of acquisitions of portfolios / companies

Private Equity

Due diligence and risk review for a German corporate